About Insurance Brokerage

Table of Contents7 Easy Facts About Insurance Brokerage DescribedInsurance Brokerage Can Be Fun For AnyoneInsurance Brokerage Things To Know Before You BuyNot known Factual Statements About Insurance Brokerage The Ultimate Guide To Insurance BrokerageInsurance Brokerage Can Be Fun For Everyone

e., for making taxed products for factor to consider) based on specific problems and limitations. Unique ITC allotment regulations apply where the insurance representative or broker is a banks. 25. The complying with magazines supply more info on ITCs: 26. Where the insurance agent or broker is a staff member of, as an example, an insurer or insurance policy agency, any type of solutions supplied to the employer by that employee that associate with the workplace or work of that worker are omitted from the definition of a "service" under subsection 123( 1 ).1) the service of providing an insurance firm or an individual that provides a service referred to in paragraph (j) with an evaluation of the damages created to home, or in the instance of a loss of building, the worth of the residential or commercial property, where the provider of the assessment inspects the residential or commercial property, or in the situation of a loss of the residential property, the last-known location where the residential property was situated before the loss, (k) any supply deemed by subsection 150( 1) or section 158 to be a supply of a financial service, (l) the accepting offer, or the setting up for, a service that is described in any of paragraphs (a) to (i), and also not referred to in any of paragraphs (n) to (t), or (m) a recommended solution, (see area 3 of the Financial Solutions as well as Financial Institutions (GST/HST) Laws), however does not consist of (n) the settlement or receipt of money as consideration for the supply of home various other than an economic instrument or of a service aside from an economic solution, (o) the payment or invoice of cash in settlement of a claim (besides a claim under an insurance coverage) under a service warranty, assurance or comparable plan in respect of residential property other than a inancial tool or a service aside from an economic service, (p) the service of supplying guidance, besides a solution included in this meaning as a result of paragraph (j) or (j.

Insurance Brokerage Things To Know Before You Buy

2) a financial obligation collection solution, rendered under an agreement between a person agreeing to supply, or organizing for, the service as well as a certain person aside from the debtor, in respect of all or part of a financial obligation, consisting of a solution of attempting to collect, scheduling the collection of, discussing the repayment of, or recognizing or attempting to realize on any security given for, the debt, but does not consist of a solution that consists exclusively of accepting from a person (aside from the specific person) a repayment of all or part of an account unless under the terms of the arrangement the person making the service might attempt to gather all or part of the account or may realize or attempt to understand on any kind of safety and security provided for the account, or the principal company of the person rendering the service is the collection of financial obligation, (r (Insurance Brokerage).

4) a service (other than a proposed service *) that is preparatory to the stipulation or the potential arrangement of a service referred to in any one of paragraphs (a) to (i) and (l), or that is supplied in combination with a solution referred to in any of those paragraphs, as well as that is a solution of collecting, collating or giving info, or a market research, product style, document prep work, paper navigate to these guys handling, consumer support, marketing or marketing service or a similar service, (r.

The Greatest Guide To Insurance Brokerage

— Cloud Links (@ldcloudlinks) December 20, 2022

Brokers collaborate with several insurance policy companiessometimes dozensso they have plenty of choices. When the broker recognizes the ideal insurance plan and supplier, they provide the quote to their client who can decide to get or otherwise to purchase. If the client buys, the insurance policy carrier will pay the broker a compensation.

In support of their consumers, brokers help coordinate costs payments, request plan modifications, and also make suggestions come renewal time. Some brokers use aid with the insurance claims process, though the actual insurance claim still has to be made directly with the insurance coverage service provider. Brokers make compensation on the policies that they offer.

Facts About Insurance Brokerage Uncovered

The compensation is based on the premium amount and can be as high as 20%, relying on the kind of insurance coverage. Some brokers likewise bill a broker agent fee, which is paid by the customer, as opposed to the insurer. Insurance Brokerage. Brokerage firm costs are not usual method, however. In lots of territories, they aren't also enabled.

How Insurance Brokerage can Save You Time, Stress, and Money.

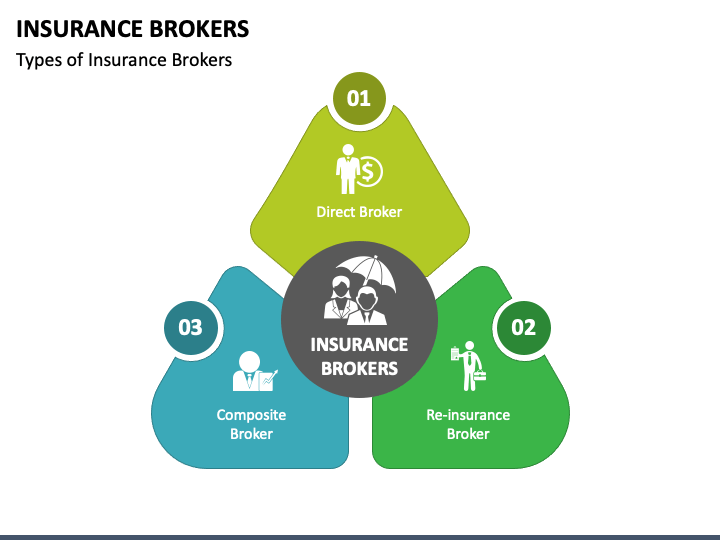

Insurance coverage brokers are various from representatives. Agents work for insurance policy companies; brokers do not.

The 10-Second Trick For Insurance Brokerage

Insurance brokers are independent; they do not benefit insurance provider. They are complimentary to negotiate with any insurance firm with whom they have a special info contract. The insurer pays the broker a commission if their customer purchases a policy. Look it up in The Insurance coverage Glossary, you can look here house to dozens of easy-to-follow meanings for the most common insurance policy terms.