Recognizing the Benefits of Medicare Supplement in Insurance Coverage

Navigating the complex landscape of insurance coverage alternatives can be a difficult job, particularly for those approaching old age or already enlisted in Medicare. Amidst the array of options, Medicare Supplement plans stand out as a beneficial resource that can supply peace of mind and financial safety and security. By understanding the advantages that these strategies offer, individuals can make educated decisions about their medical care insurance coverage and make certain that their demands are effectively fulfilled.

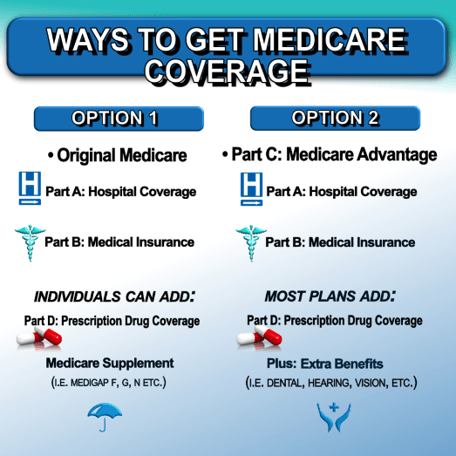

Significance of Medicare Supplement Plans

When taking into consideration healthcare protection for retired life, the importance of Medicare Supplement Program can not be overstated. Medicare, while comprehensive, does not cover all medical care expenditures, leaving individuals potentially susceptible to high out-of-pocket expenses. Medicare Supplement Program, likewise known as Medigap plans, are designed to fill out the voids left by standard Medicare insurance coverage. These plans can assist cover costs such as copayments, coinsurance, and deductibles that Medicare does not pay for.

Among the crucial advantages of Medicare Supplement Plans is the comfort they supply by providing added financial defense. By paying a month-to-month premium, people can much better budget plan for medical care prices and avoid unforeseen clinical expenditures. Moreover, these strategies commonly provide coverage for healthcare solutions obtained outside the United States, which is not used by original Medicare.

Coverage Gaps Addressed by Medigap

Resolving the spaces in protection left by typical Medicare, Medicare Supplement Program, also understood as Medigap policies, play a vital duty in providing detailed medical care protection for individuals in retirement. While Medicare Part A and Component B cover several healthcare expenditures, they do not cover all costs, leaving recipients susceptible to out-of-pocket costs. Medigap strategies are designed to fill up these insurance coverage gaps by paying for particular medical care prices that Medicare does not cover, such as copayments, coinsurance, and deductibles.

By supplementing Medicare insurance coverage, people can much better handle their medical care costs and prevent unexpected monetary problems connected to clinical treatment. Medigap policies supply flexibility in picking health care carriers, as they are normally accepted by any kind of medical care carrier that accepts Medicare project.

Expense Cost Savings With Medigap Policies

With Medigap policies effectively covering the gaps in traditional Medicare, one remarkable advantage is the capacity for significant cost savings for Medicare recipients. These plans can help in reducing out-of-pocket costs such as copayments, coinsurance, and deductibles that are not completely covered by original Medicare. By loading in these monetary holes, Medigap prepares offer beneficiaries monetary comfort check that by limiting their total health care costs.

Additionally, Medigap policies can give predictability in healthcare spending. With dealt with monthly costs, beneficiaries can spending plan more properly, knowing that their out-of-pocket expenses are extra controlled and regular. This predictability can be especially useful for those on taken care of revenues or tight budget plans.

Versatility and Flexibility of Selection

Could versatility and flexibility of choice in healthcare companies enhance the total experience for Medicare beneficiaries with Medigap policies? Absolutely. Among the essential advantages of Medicare Supplement Insurance Coverage, or Medigap, is the adaptability it supplies in choosing health care suppliers. Unlike some managed treatment plans that restrict people to a network of physicians and health centers, Medigap plans usually allow recipients to go to any kind of health care service provider that accepts Medicare - Medicare Supplement plans near me. This flexibility of choice empowers people to official website choose the physicians, specialists, and medical facilities that best suit their requirements and choices.

Fundamentally, the flexibility and liberty of option managed by Medigap policies enable beneficiaries to take control of their health care decisions and tailor their clinical care to satisfy their individual needs and choices.

Rising Popularity Amongst Senior Citizens

The rise in appeal among elders for Medicare Supplement Insurance, or Medigap, underscores the expanding recognition of its advantages in boosting medical care insurance coverage. As senior citizens browse the complexities of medical care options, numerous are transforming to Medicare Supplement intends to fill the spaces left by standard Medicare. The assurance that includes knowing that out-of-pocket prices are decreased is a substantial factor driving the enhanced rate of interest in these policies.

Furthermore, the adjustable nature of Medicare Supplement intends permits elders to customize their protection to suit their individual medical care requirements. With a variety of strategy choices readily available, senior citizens can pick the combination of benefits that ideal lines up with their medical care requirements, making Medicare Supplement Insurance an appealing choice for lots of older adults wanting to protect comprehensive coverage.

Final Thought

Finally, Medicare Supplement Plans play an important check here function in addressing protection gaps and saving costs for elders. Medigap policies supply flexibility and liberty of choice for individuals seeking additional insurance protection - Medicare Supplement plans near me. As a result, Medigap plans have seen a surge in appeal among senior citizens who value the advantages and assurance that come with having thorough insurance policy coverage